Merit Based Incentive Payment System MIPS

MIPS Healthcare Definition

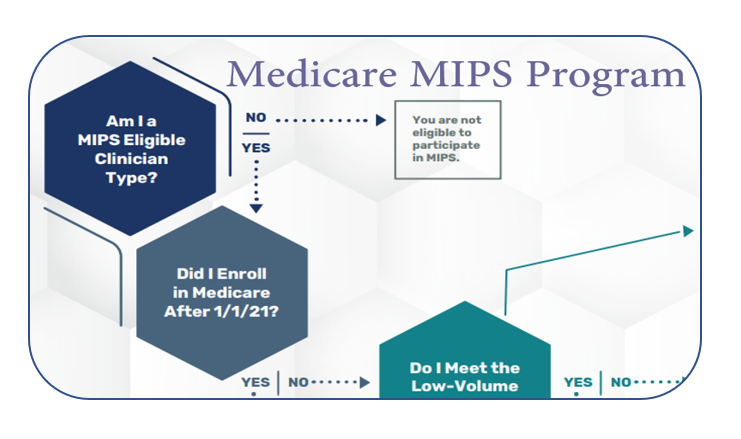

The MIPS Healthcare is also known as Merit-Based Incentive Payment System (MIPS) is the program that will determine Medicare payment, adjustments, and/or penalties. The MIPS Healthcare system analyzes the performance score of eligible clinicians and they may receive a bonus payment, penalty, or no payment adjustment. The Merit-based Incentive Payment System (MIPS) is one among two tracks under the standard Payment Program.

What is a MIPS Healthcare or Merit-Based Incentive Payment System (MIPS)

MIPS Healthcare has 3 programs with unique conditions attached to them. One is Physician Quality Reporting System PQRS. The second one is the Value-Based Payment Modifier (VM) Program. The third one is Medicare Electronic Health Record (EHR) Incentive Scheme.

All Medicare Part B healthcare providers who meet the definition of MIPS eligible clinicians should participate in MIPS. In the past, if any eligible clinician didn’t participate in the MIPS program, they were subject to a 4% negative payment adjustment on Medicare Part B reimbursements. For more details, get in touch with your Medical Billing Company, and/or EHR Software Vendor.

MIPS Healthcare and Participation as Individual vs. Group Reporting

One unique aspect of MIPS Healthcare is that eligible clinicians have the option to participate as either a private or as a part of a group provider. A privately eligible clinician is supposed to report MIPS data to CMS under an NPI number that’s tied to their TIN. Two or more eligible clinicians (with unique NPIs) who have reassigned their billing rights to a single TIN have the choice to participate in MIPS as a group. If they are eligible clinicians prefer to participate in MIPS as a group, they’re going to be assessed as a group across all four MIPS performance categories.

MIPS Eligible Clinician types:

Physicians (includes doctors of medicine, osteopathy, dental surgery, dental medicine, podiatric medicine, and optometry; osteopathic practitioners; and chiropractors (with respect to certain specified treatment, a Doctor of Chiropractic legally authorized to practice by a State in which he/she performs this function)), Physician Assistants, Nurse Practitioners, Clinical Nurse Specialists, Certified Registered Nurse Anesthetists, Clinical Psychologists, Physical Therapists, Occupational Therapists, Qualified Speech-Language Pathologists, Qualified Audiologists, Registered Dietitians or Nutrition Professionals, groups or virtual groups that include one or more of these MIPS eligible clinician types.

Low-Volume Threshold Criteria for 2021:

Bill more than $90,000 for Part B covered professional services under the Physician Fee Schedule; AND

See more than 200 Part B patients; AND

Provide more than 200 covered professional services to Part B patients

To achieve QP status in 2021, you must:

Receive at least 50% of Medicare Part B payments; OR

See at least 35% of Medicare patients through an Advanced APM Entity.

Additionally, 75% of practices need to be using CEHRT within the Advanced APM Entity.

To achieve partial QP status in 2021, you must:

Receive at least 40% of Medicare Part B payments; OR

See at least 25% of Medicare patients through an Advanced APM Entity.

Important Notice and Change in Law:

The Consolidated Appropriations Act, 2021 was signed on December 27, 2020. Under this law, the Qualifying Participant thresholds for the payment for years 2023 and 2024 will be frozen at 50% for the payment amount threshold and 35% for the patient count threshold (Need to consider that the applicable performance years will be 2021 and 2022). The partial Qualifying participant thresholds have also been frozen at the same levels used for the 2022 payment year and 2020 performance year.

Reference:

2021 MIPS Overview, Eligibility Requirements & Reporting Measures

Medical Billing Service, iCareBilling.com

Medical Billing Service, iCareBilling.com

Medical Billing Company, www.icarebilling.com.

Medical Billing Company, www.icarebilling.com.